More information

Take a look at our FAQs to understand more about how we can help you.

Where to invest your money is an important consideration but there are other things that need to be considered first. Before we start this process we ask a series of ‘why’ questions eg: Why is money important to you? Why have you invested the way you currently have? Answering these, and other questions, will help us formulate some goals and objectives for you. Experience has shown us that this step is often missed or overlooked but at Freya Financial we think it is very important in the final make up of your investment strategy.

From there we can begin to understand the level of risk you are willing to take on – we call this a ‘Risk Profile’. Once you understand your Risk Profile you can look at investment options. There is no right or wrong answer here – the most important thing is that you are completely comfortable with how your money is invested.

There are five main asset classes for investment. The more defensive asset classes are Cash and Fixed Interest, while growth assets consist of Property, Australian Equities and International Equities. It’s important to remember: the more growth-oriented the asset, the more fluctuations that will occur – but while you take on greater risk, you will also have the potential for greater returns.

Salary sacrifice is a contribution you make to superannuation from your wages before your income is taxed and paid to your bank account. These contributions may be taxed at a lesser amount than your marginal tax rate (depending on how much you earn) and potentially reduce your assessable income. That just means you may save on tax – and this will help to build your retirement savings more effectively.

We call this ‘the million dollar question’ – but don’t worry, we don’t mean you’ll need a million dollars. It is all relative to your retirement dreams and goals.

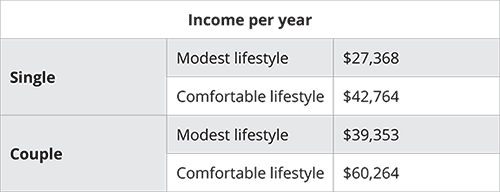

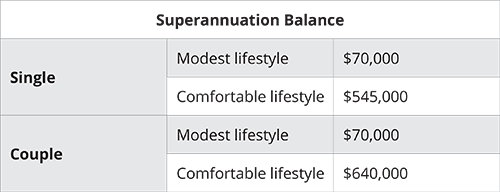

To give you an idea, the Association of Superannuation Funds Australia (ASFA) publish a Retirement Standard that is updated every quarter. This outlines the income required, and superannuation balance needed, to fund that income for singles and couples.

This guide refers to two standards: a ‘Modest lifestyle’ which is better than the Age Pension but still only means you are able to afford fairly basic activities; and a ‘Comfortable lifestyle’ which enables an older, healthy retiree to be involved in a broad range of leisure and recreational activities and to have a good standard of living through the purchase of such things as; household goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment, and domestic and occasionally international holiday travel (Superannuation.asn.au, 2018). Both lifestyles assume you own your own home.

As an example, the ASFA Standard for March 2018 outlines the income required is as follows:

The superannuation balance required to achieve a ‘modest’ or ‘comfortable’ lifestyle:

Note: These figures are only a guide and your income and superannuation requirements will depend on your individual circumstances.

This is a very personal decision and one that should be made based on what works best for your family and their circumstances and there really is no right or wrong answer. From a financial point of view, the important thing is that (where possible) you plan for this time. There are many ways to do this.

One strategy may be to increase contributions to superannuation prior to commencing your maternity leave to make up for the time you will not be working and therefore not receiving employer contributions.

The other consideration in your decision should be based on how long you are able to sustain your lifestyle and financial commitments on the income you will have whilst on maternity leave. Again, planning is key to making this special time as stress-free as possible.

When you stop work, for any reason, your superannuation fund will remain active. For most people, superannuation is a function of your income. As a rule, while you are working fulltime your employer pays Superannuation Guarantee Contributions to your fund, so when you stop work for any reason, these contributions will also stop.

This is one of the many common problems parents face when they stop work to raise children and as mentioned, planning for this period in your life is important.

At Freya Financial, the first thing we do is listen – to understand you, your dreams and your goals. Having this information – and a thorough understanding of your current financial situation – will help us to develop strategies to get you where you want to be.

These recommendations will be presented to you in a Statement of Advice and only implemented once we have your full agreement. It is then important that we stay in contact with you to ensure your strategy remains appropriate to your needs. If appropriate, we have several ongoing service packages that we can offer you to ensure this happens more regularly.

As with most things, the costs involved depend on your circumstances and the strategies that need to be developed – so it is difficult to be exact. But we can say that all it takes is a quick phone call and we will be able to give you a better idea of the costs involved.